NI and the budget

Find out how the recent government budget may affect your business, and how Salary Sacrifice can help!

Following the Chancellor's budget, announced in October 2024, there are significant changes to National Insurance Contribution (NIC) taxes that may affect you as an employer. As a way of mitigating this, it is anticipated that some employers may choose to start offering a Salary Sacrifice scheme to their employees - helping them reduce their NIC bill, while allowing their employees to drive a brand new electric vehicle at a reduced cost.

When an employer decides to set up a Salary Sacrifice scheme for the benefit of their employees, the amount of salary the employee gives up is deducted before income tax and National Insurance are calculated. This means your overall income is reduced for tax and NI purposes. As a result:

- Lower NI Contributions - Since National Insurance is based on an employee's income, sacrificing part of their salary reduces the amount they earn for NI purposes. This can reduce the amount of NI they pay. For example, if they sacrifice £100 of your salary, they will not pay National Insurance on that £100, and their overall NI contribution will be lower.

- Employer NI Savings - Employers also pay NI on the salaries of their employees. By reducing your salary through Salary Sacrifice, your employer’s NI contributions are also reduced, which can result in savings for the business. Some employers may choose to pass on these savings to employees or use them to fund additional benefits.

The annual budget may have a direct impact on both National Insurance rates and the tax treatment of benefits provided through Salary Sacrifice. The government may adjust both NI rates and the types of benefits eligible for Salary Sacrifice, which can influence how much employees and employers save.

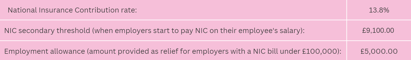

2024-25 Rates

The rates for National Insurance Contribution (NIC) for employers for the 2024-25 tax year are provided below. This is what you would have paid for the previous tax year.

We can see that there are seemingly small changes to the NIC rate that employers will have to pay for employing people to work in their businesses. However this small change in percentage, as well as a lower secondary threshold, can work out to thousands of pounds that companies will have to absorb into their costs.

Likewise, the secondary threshold has been reduced, meaning employers pay NIC on more of the employee's salary than the previous year.

For example, for an employee earning £40,000 - under the previous rules, an employer paid £4,264.20 whereas now they pay £5,250.00. This is an increase of over 20% compared to the previous year.

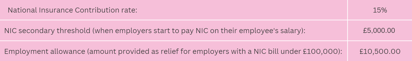

For some employers, there is relief available in the form of the Employment Allowance, which has increased to £10,500 from £5,000 the previous year. Previously this was only paid to companies with a NIC bill of under £100,000 so only helped smaller employers with a lower NIC bill. However, this has been abolished and is now available to all employers.

2025-26 changes

As of 6th April 2025, the National Insurance Contribution policy will change to the following:

Why have these changes happened?

In 2024, after a general election, a new government was formed. Following consultations with the Office of Budget Responsibility, the government found a £22 billion deficit in current budget plans, therefore requiring either tax rises or budget cuts to 'plug the hole'. As a result, the new government has decided to increase NIC as a way to boost government tax receipts in order to spend more on government services - which require a significant increase in funding.

As many people are aware, the UK's economic growth over the last few years has been low, averaging around 1.5% per year. There are many factors for this, including low economic productivity, Brexit and COVID-19 pandemic related disruptions, as well as government austerity measures. During the election campaign, Prime Minister Keir Starmer ruled out tax rises on 'working people' to avoid any extension to the current 'Cost of Living Crisis'. Thus, they have decided that these tax increases should fall on businesses.

What this means for employers

These National Insurance Contribution rises mean that employers will need to pay considerably more for hiring employees and keeping employees on their payroll. For many businesses, this will be seen as a disincentive for hiring new staff - which could mean higher unemployment across the country. This however is unlikely, as there are hundreds of thousands of job vacancies across a multitude of sectors, as well as low unemployment to start with - as the UK's current unemployment rate sits around 4.4%. This could also mean that future employees may see a reduction in the salary they may otherwise have received, since lowering salaries reduces the NIC that the employer pays for that employee. Higher staffing costs also disincentivise businesses to reinvest profits into their businesses, therefore possibly reducing the productivity of their workforce and hampering business growth.

This may lead to further economic slowdown, especially due to the current 'cost-of-living crisis' meaning salaried employees could be worse off overall due to a combination of this and higher prices from businesses recouping lost revenue due to increased staffing costs. On the other hand, it may be exactly what the government needs to spur economic growth, reducing their deficits and lowering the amount taxpayers spend on public debt interest - for higher spending on public services.

How we can help

At Citygate Leasing, we are here to help you with the cost of your NIC bill, whilst offering a great benefit to your employees at the same time through our Salary Sacrifice scheme.

Salary Sacrifice car schemes have been growing in popularity amongst small, medium and large businesses in the last few years. Employees get to save up to 60% on a brand-new electric vehicle (EV), whilst employers get to reduce the amount they pay on National Insurance Contributions.

Here's how it works: the employee chooses to sacrifice some of their salary to lease a brand new EV through our online portal. This calculates their savings on income tax and National Insurance, based on their current earnings. Employers reduce the gross pay of their employee due to them sacrificing a portion of their salary, therefore reducing the salary on which the employer pays NIC on.

These savings can be significant too. An employee, earning £40,000 per year, and leasing a car through Salary Sacrifice at £350 per month, would mean the employer would save £630 per year in NIC for that employee. That means the employer would pay a NIC rate of 11.5% instead of the 15% they would without the salary Sacrifice Scheme set up.

What's the cost to the employer? Nothing. At Citygate Leasing, we don't charge to setup your company's Salary Sacrifice scheme. It's also really simple to do. We can set your scheme up in just 24 hours after your initial consultation - and provide informational material to your employees and any support you'll need.