Our guide to leasing

The Ultimate Guide to Car Leasing in the UK

What is PCH?

Personal Contract Hire (PCH), often referred to as ‘personal leasing’, is an agreement where the customer has the use of a vehicle of their choice, for an agreed length of time, for a set fee - very similar to a rental agreement.

With PCH, you have complete control of what vehicle you want to drive, including the make, model and the specification (including colour and trim etc). Agreements can be tailored to your requirements, meaning you can choose the length of contract (normally between 2 to 5 years), annual mileage and payment structure.

The cost of the lease is then broken down into equal monthly payments. You even get to control how much you pay each month, determined by how many rentals you choose to pay at the beginning of your agreement. This is known as the ‘initial rental’, which is usually between 1 to 12 months of your monthly rental.

This is known as a ‘3+35’ agreement, as there are 3 months initial rental in the first month, followed by 35 months of the monthly rental price.

When the lease comes to an end, you just simply hand the car back to be checked over and your monthly payments stop, leaving you free to lease again from scratch.

Our leasing partners will usually collect your car for free at the end of your lease. If you have planned well enough ahead, you could potentially get your new lease car dropped off at the same time your old lease car is being collected.

PCH vs PCP vs Outright Purchase?

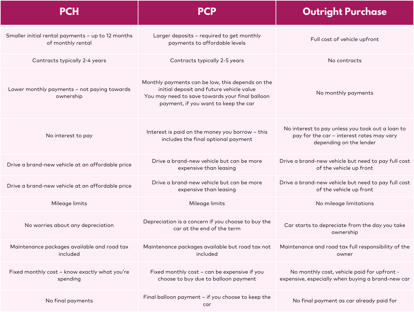

More and more people are looking at Personal Contract Hire instead of an Outright Purchase or Personal Contract Purchase (PCP) as it can prove to be a more cost-effective way of driving a new car.

High deposits, heavy car depreciation, and repair and maintenance costs associated with car buying and owning a car are some of the reasons personal car leasing is quickly becoming the cheapest way to drive a brand-new car, due to the considerable amount of money you can save over the lease period. With car leasing, your monthly outgoings can be significantly lower compared with other types of finance.

Road tax, manufacturer’s warranty and delivery & collection are all included in a car lease agreement - so even less hassle for you.

Insurance is the only thing you will have to arrange yourself.

Benefits of personal leasing

- Lower monthly payments

Leasing can result in lower monthly payments than buying a car with a loan or PCP. This is because you pay for the car's depreciation during the lease term rather than the entire purchase price. - Drive a new car more frequently

Leasing allows you to drive a new car every few years, so you can always enjoy the latest models and technology without the hassle of selling or trading in your old car. - Minimal upfront costs

Leasing usually requires a smaller deposit compared to buying. This makes getting a new car cheaper with a less significant initial outlay. - Maintenance and warranty

Leased cars are often covered by the manufacturer's warranty for the duration of the lease, potentially reducing maintenance costs. Leases can even include maintenance packages at an extra fixed cost. - No resale worries

At the end of the lease, you return the car and can choose a new one, avoiding the complexities and depreciation concerns of selling a vehicle.

Who can get a personal lease?

Almost everyone can get a personal lease. There are some criteria to pass dependent on the lease provider. This will normally include having a valid UK Driver’s Licence and being a UK resident.

You will also have to pass a personal credit check as part of the application process. This is an easy process, which is made even easier if you have a healthy credit status, but not to worry, if you have poor credit, you may still be able to lease. This decision will be made by the leasing company and not by us as a broker.

How our car leasing works

- Choose your car

Decide on the make and model of the car you want to lease. Consider size, fuel efficiency and features that best suit your needs. - Select a lease term

Lease terms typically range from 24 to 48 months. Choose a term for your budget. - Determine your mileage needs

Leases will include a mileage limit. Estimate your annual mileage and select a lease with a mileage allowance that matches your driving habits. Exceeding this limit will incur additional charges. - Review the terms and conditions

Read the lease agreement carefully. Pay attention to the terms regarding wear and tear, maintenance responsibilities and any end-of-lease charges. - Sign the agreement

Once you're happy with the terms, sign the lease agreement. You may need proof of identity, address, and financial status. - Enjoy your new car

Drive your new vehicle and enjoy the benefits of leasing. Keep up with regular maintenance and adhere to the agreed mileage limits. - End of lease options

At the end of the lease term simply return the vehicle. Ensure you return the vehicle in good condition to avoid extra charges.