Company cars or Salary Sacrifice?

Explaining the differences between company cars and Salary Sacrifice.

Getting a car through your company or salary is an attractive benefit for employees, and it means employers keep their team safe and happy in a new car.

However, while Salary Sacrifice and company car schemes result in an employee getting a car through their employer, there are several key differences. So, which is better? What’s the difference between Salary Sacrifice schemes and a company car?

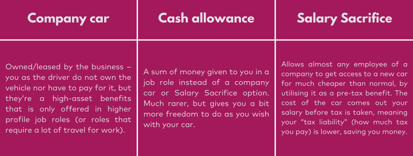

We’ll break it down for you, but, in short:

What is a company car?

A company car is owned, leased, or subscribed via the company itself, and isn’t paid for by the employee.

How do company cars work?

Generally speaking, companies will either offer a “company car allowance” to their staff (which they can use to go and find a car of their choosing) or they’ll simply give a car to the employee that the business purchases themselves.

If owned by the business, a company car is treated as a fixed asset, which can have several tax implications such as depreciation. They’re often offered to senior employees or those who spend a lot of time commuting or travelling between locations.

As a company car driver, you may have some restrictions on what the car can be used for and how many miles you drive per year, and your salary should not fall below the national minimum wage.

What’s good about a company car…

- The employee is not financially responsible for the car. It’s the company’s responsibility to make sure it has a valid MOT and is serviced on-time (though, of course, you should look after it).

- Companies sometimes offer a fuel card with the car, meaning you could get discounted refuelling.

- It’s a great incentive for new joiners to join your company, if you’re a business owner.

Why a company car might not work for you…

- Roles with company cars are hard to find and it means they’re only available for certain members of staff and some companies may not let you choose the car (so you could end up driving something you don’t like).

- There could be increased liability if you use the car outside of given restrictions (i.e. any personal use you’re not entitled to).

- If fuel is included in your company car benefit, you could end up having to pay what’s known as ‘Fuel Benefit Tax’ (an extra tax you pay for using fuel that’s paid for by your employer).

What is Salary Sacrifice?

A Salary Sacrifice scheme means employees “sacrifice” some of their gross salary in return for something, like a car for example, by their employer.

How does it work?

We’ve already gone into detail on how Salary Sacrifice works but to summarise, instead of paying for something using your post-tax pay (the money you receive in your bank account from your employer), the item is paid for before tax is deducted.

That’s important because it means your overall pay is therefore lower, meaning you’re taxed less by HMRC. Less tax means more take-home pay for you, meaning you could save on average 30-60% on the cost of that item compared to if you were to pay for it traditionally.

How much will Salary Sacrifice save me?

A Salary Sacrifice scheme can save you 30-60% on the cost of an electric car.

That’s because the subscription cost is deducted from your pre-tax pay, making your taxable income lower.

And, there’s normally no deposit to pay on a Salary Sacrifice lease, meaning it’s just as easy to access from the off as a company car. A Salary Sacrifice lease will normally also come with insurance, maintenance and tax included, making it hassle free.

Are you an employer? Set up a scheme for your business.

Are you an employee? Get the info to convince your employer.

What is a cash allowance?

A cash allowance is what some companies may give you instead of a company car itself. It’s essentially a lump sum added to your salary that you can use to buy, finance or lease to a car of your own choosing.

Because company car tax has increased in recent years, particularly for diesel cars or high polluting petrol models, a cash allowance could be a more affordable, long-term solution for you. But you’ll get less support from your employer with the vehicle because it’s not their responsibility.

What’s good about a cash allowance

- You can choose whatever car you like, and pay for it whichever way you prefer, because it’s your money.

- The car is yours, not the companies, so you can keep it as long as you like or even take it with you if you leave the company.

Why a cash allowance might not work for you

- Because the car is entirely your responsibility, you need to arrange the servicing, maintenance and ensure it is roadworthy with an MOT.

- If you lease, subscribe or finance the car, you’ll need to stay within the given mileage limits.